reverse tax calculator uk

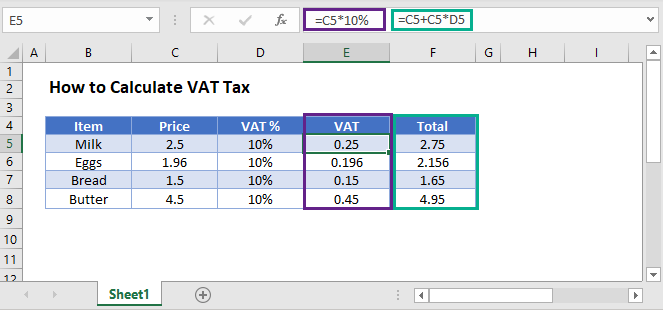

Amount with VAT 1 VAT rate 100 Amount without VAT. Standard VAT 2015 rate 20 The standard VAT tax applies to all sales transactions of goods or services that are not part of the other categories.

How Stripe Calculates Tax Stripe Documentation

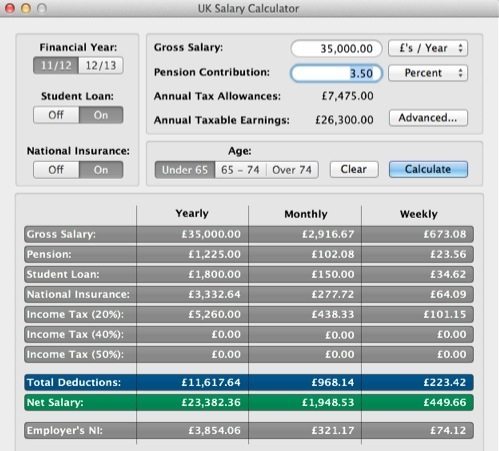

See how tax is deducted from your annual salary using this interactive visual income tax breakdown.

:max_bytes(150000):strip_icc()/dotdash-reverse-mortgage-or-home-equity-loan-v3-eb9ddc756b1d47adba885c60bf2f854c.jpg)

. The calculator will automatically adjust and calculate any pension tax reliefs applicable. The VAT percentage is set at 20 as standard. Here is how the total is calculated before VAT.

Using this web based calculator you can calculate the gross pay before tax for a required level of take home pay. Income Tax Calculator See how tax is deducted from your annual salary using this interactive visual income tax breakdown. Formulas to calculate the United Kingdom VAT.

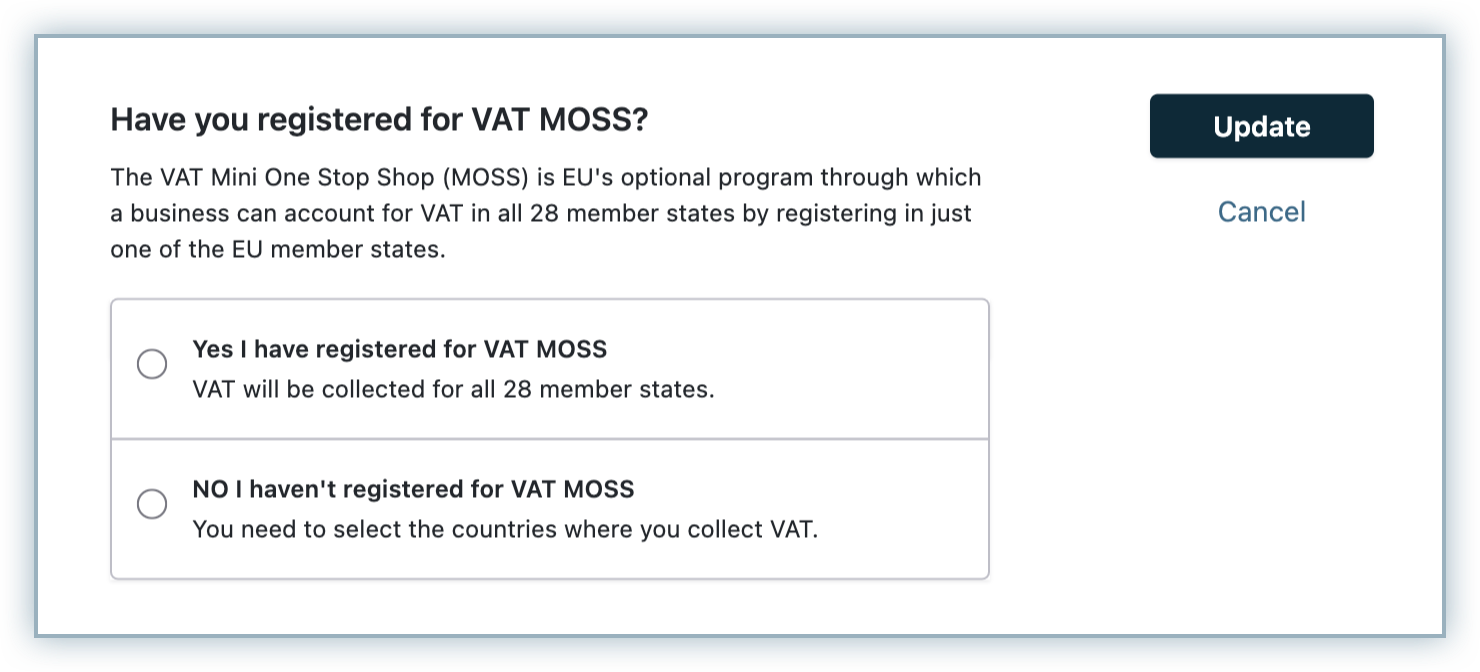

Makes working with UK VAT value added tax really easy - even reverse VAT calculations. You may reclaim the input tax on your reverse charge purchases subject to the normal VAT rules. The basic rate of tax which applies all income from 12571 to 50270 20 per.

Amount without sales tax. Calculate your salary take home pay net wage after tax PAYE. Income Tax Calculator is the only UK tax calculator that is EASY to use FREE.

If contribution 50 enter 50. Margin of error for HST sales tax. - Calculate using 20 Standard VAT Rate or 5 Reduced VAT Rate.

Cash accounting scheme. The VAT Calculator above is used for calculating this rate. This is the VAT rate most commonly used in the UK and covers most goods and services.

Try out the take-home calculator choose the 202223 tax year and see how it affects. UK customer to account for the output tax. Due to rounding of the amount without.

If you know your tax code enter it into the tax code box for a more accurate take-home pay calculation. For example 120 is the figure 12. There are times when you may want to find out the original price of the items youve purchased before tax.

Instead of using the reverse sales tax calculator you can compute this manually. UK 2022 2023. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

At present the tax rates you pay in each band if you have a standard personal allowance of 12570 are. Simply input the number you need to calculate VAT on and select either Add VAT or Remove VAT to add or subtract a VAT percentage. The VAT increased from 175 to 20 on 4.

Have you ever wondered how much you paid for an item before the sales tax or if the sales tax on your receipt was correct. Now you can find out with our Reverse Sales Tax Calculator Our. To use the sales tax calculator follow these steps.

Amount with vat 1 vat rate 100 amount without vat. Here is how the total is calculated before sales tax. It responds instantly to changes made to gross income and.

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023. In short work backwards from the money you want to take home to the Gross. It responds instantly to changes made to gross income and.

Please note if your. The Standard VAT rate in the UK is 20. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a. If you are unsure of your tax code just leave it blank and the default code will be. So if contributing 5 percent enter 5.

Reverse Sales Tax Calculations. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Reverse Tax Salary Calculator Product Information Latest Updates And Reviews 2022 Product Hunt

How To Calculate Vat Tax Excel Google Sheets Automate Excel

Six Apps To File Taxes On The Mac Chriswrites Com

Uk Tax Calculators 2022 2023 On The App Store

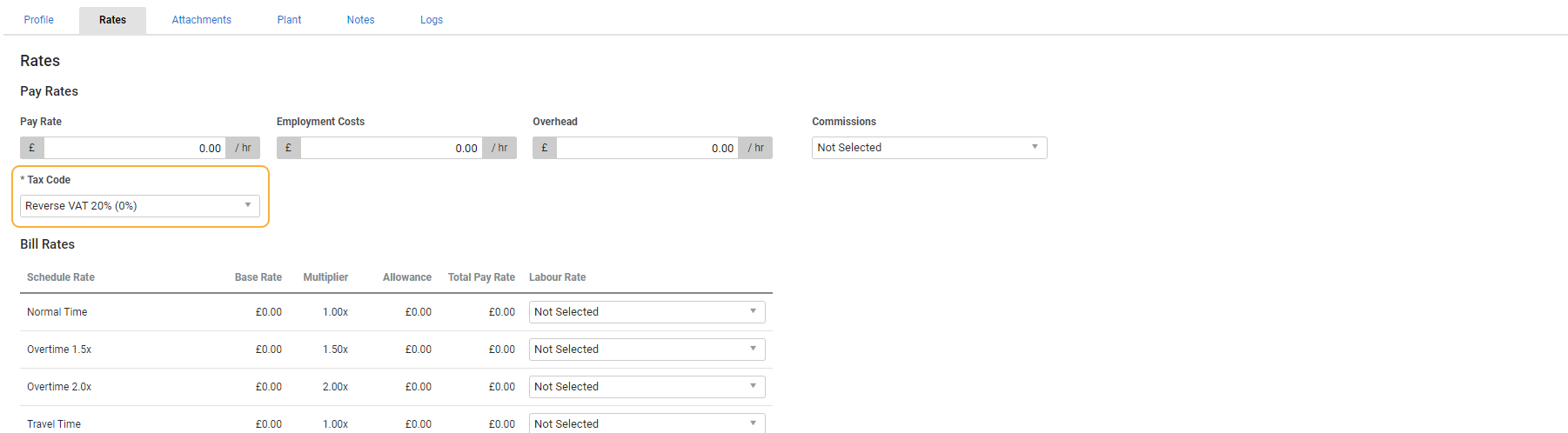

How To Manage Domestic Reverse Charge Tax Simpro

Indian Gst Calculator Gstcalculator Net

Reverse Stock Split Formula Ge Example And Calculator

Imf Urges Truss To Reverse Top Rate Tax Cut In Rare Intervention

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

Irs Tax Refund 2022 How To Calculate Your Refunds For This Year Marca

What Is A Reverse Merger How Do They Work Forbes Advisor

How To Adjust Your Dynamics Gp Solution To Reflect The Reduced Rate Of Vat

Conservative Tax Cut Plans Will Widen Inequality Uk In A Changing Europe

Alberta Gst Calculator Gstcalculator Ca

Download Uk Vat Taxable Turnover Calculator Excel Template Exceldatapro

Reverse Gst Calculator How To Calculate Reverse Gst Legaldocs